amazon flex tax forms uk

Aquí nos gustaría mostrarte una descripción pero el sitio web que estás mirando no lo permite. This includes miles that you drive to your first delivery pickup between deliveries and back home at the end of the day.

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

My question is as follows in relation to Amazon Flex and claiming mileage.

. Most drivers earn 18-25 an hour. You can talk about anything here. Board Information Statistics.

Use commercial software such as GoSimpleTax to do this for you. Were here to help. Not every Amazon seller gets a 1099-K form from Amazon.

Fill in the main tax return form SA100 You can do this in one of three ways. To find an Amazon Flex UK depot just download the app and itll let you know which depots are. Tax Returns for Amazon Flex.

Tracking the mileage you drive for work is time-consuming. Get your 1099-NEC from Amazon Flex. Hi Im trying to my first tax return.

All I can do is ignore it upload other forms in the hope they will accept something so far everything has been declined including Tax Return which has UTR number. 2021 1099 MISC Forms with TaxRight Software Formerly Known as TFP 50 Vendor Kit of Laser Forms Designed for QuickBooks and Accounting Software TaxRight Disc and 50 Self Seal Envelopes Included. Finding an Amazon Flex Depot near me.

Payee and received nonemployee compensation totaling 600 or more Amazon is required to provide you a 1099-NEC form as well as report these amounts to the IRS. If you think you should have received a form 1099-K but didnt you can check on it in your Seller Central Account. Submit via the HMRC website and get instant acknowledgement after submission.

I am aware that being classed as self employed means I will need to fill in a self assessment tax form my first one being due by January 2020 I guess and I have read up about the mileage allowance in this UK. In the name of AMAZON FLEX LIMITED and the application made to the Company Names Tribunal by AMAZON EUROPE CORE. Are you making money by driving for Amazon Flex.

First of all youre using a 1099 for Flex not a 1040. Not finding what you need. However if you have at least 50 transactions you still need to provide your tax status to Amazon.

The NEC stands for nonemployee compensation and it distinguishes this form from other types of 1099s all of which are used to report various kinds of income. Im still being asked to upload a Business Tax Registration form but I dont have one my accountant doesnt know what they mean yesterday I rang HMRC they dont know what Amazon want. Self-employed individualslike Amazon FlexFBA workerscan deduct their business mileage.

1 Login to Seller Central. If you are a US. Passengers and pets except for service animals must not have any interaction with customers.

P60 or other records of the income youve already paid tax on. This board has 1 moderator. Yes 930 taxable of which you will owe 153 for SS and Medicare and then add in whatever your normal tax bracket is.

Keeper helps you to. Amazon will send you a 1099 tax form stating your taxable income for the year. Become an Amazon Flex Delivery Driver in the UK.

Form 1099-NEC reports the annual income you earned from an independent contracting gig like driving for Amazon. Use caution to avoid misspellings or entering incorrect Tax Identification Numbers which can result in an invalidated tax form. Youll need to submit a tax return online declaring your income and expenses once a year by 31 January as well as paying tax twice a year by 31 January and 31 July.

Youll need to declare your amazon flex taxes under the rules of HMRC self-assessment. When I include my full time employment cash in the employment section it wants me to pay over 3k in tax. Amazon will either mail or email you your form 1099-K depending on whether or not you consented to having tax forms sent to you electronically.

If you want to contact them through the Amazon Flex support email its email protected. Amazon Flex - AU. Yeah as far as I can tell you can fill our your assessment online and include relevant expenses milage while youre deliveringgoing to and from the depot which will not be taxed only the profit you make.

Second I suggest you either use tax software like TurboTax or hire a CPA. Use your own vehicle to deliver packages for Amazon as a way of earning extra money. Your vehicle must have enough space to safely accommodate any passenger or pet and all parcels assigned to your block.

4y Phoenix Mod. You can also send a paper tax return to HMRC in the post until 2023. I have a full time job and in 20192020 I made about 1200.

Im fairly positive we have to register as self employed too and not. 46 out of 5 stars. Form 1099-NEC is replacing the use of Form 1099-MISC.

To meet the requirements for a 1099-K you must have both 20000 in total sales and 200 individual transactions. What is the Amazon Flex contact number UK. 2 Go to the Reports Section.

You are required to notify Amazon of any change to your tax identity information by retaking the tax information interview if the change could invalidate your W-9 W-8 or 8233 form. Amazon Flexs UK contact number is 080 8145 3757 with lines available from 0900 to 2100. Amazon Flex pays 13-15 an hour.

Deliver Amazon parcels in your own car near you. Notice of change of company name in the matter of company registration no 11639665. Use your own vehicle to deliver packages for Amazon as a way of earning extra money.

Use your own vehicle to deliver packages for Amazon as a way of earning extra money to move you closer to your goals. Amazon flex Self Assessment UK TAX.

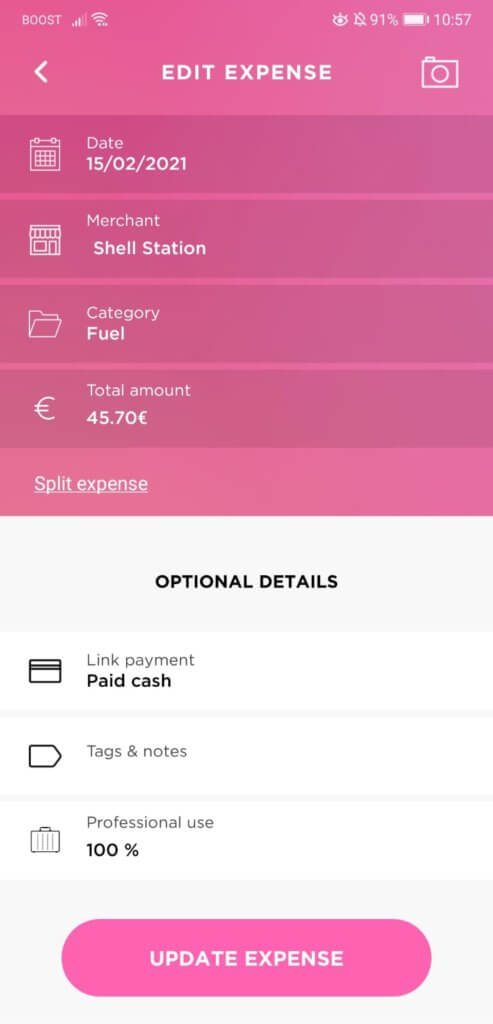

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Roxy Power Powder Women S Snowboard Helmet By Roxy Http Www Amazon Co Uk Dp B005ywfhx4 Ref Cm Sw R Pi Dp Zjpd Snowboarding Women Ski And Snowboard Snowboard

Amazon Flex Uk Self Employed Self Assessment Tax Basics Registering Basic Tax Advice Easy Youtube

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Tommys Tax Tommystaxuk Twitter

Redparts Auto Parts Html Template Stylelib Ecommerce Template Social Network Icons Woocommerce Themes

Roxy Power Powder Women S Snowboard Helmet By Roxy Http Www Amazon Co Uk Dp B005ywfhx4 Ref Cm Sw R Pi Dp Zjpd Snowboarding Women Ski And Snowboard Snowboard

How To Do Taxes For Amazon Flex Youtube

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Amazon Flex Filing Your Taxes Youtube

Lenovo Thinkvision M14 14 Inch Fhd 1080p Type C Portable Computer Monitor Gaming Display Screen For Smartphone Tablet Laptop Lcd Monitor Usb Lenovo

Great Fridays We Reframe Established Preconceptions To Turn Design Into Profit Id Design Industrial Design Design

Tax Guide For Self Employed Amazon Flex Drivers Goselfemployed Co

A Comprehensive Guide To Shipping Everything Etsy Sellers And Creative Entrepreneurs Need To Know About Sh Etsy Seller Packaging Shipping Paper Etsy Business

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

![]()

Irs Uber Mileage Log Tax Deduction With Triplog Tracking App Mileage Tracker Mileage Tracker App Tax Deductions